C2treds is simplifying the Financial Ecosystem

Break the cycle of delayed payments with faster cash flow for your business growth

C2treds helps MSMEs get quicker access to working capital tied up in their receivables. Faster payment cycles fuel economic growth through lower production costs for suppliers, timely order fulfillment for buyers, and reduced NPAs for financiers. Discover how the C2treds platform does it all.

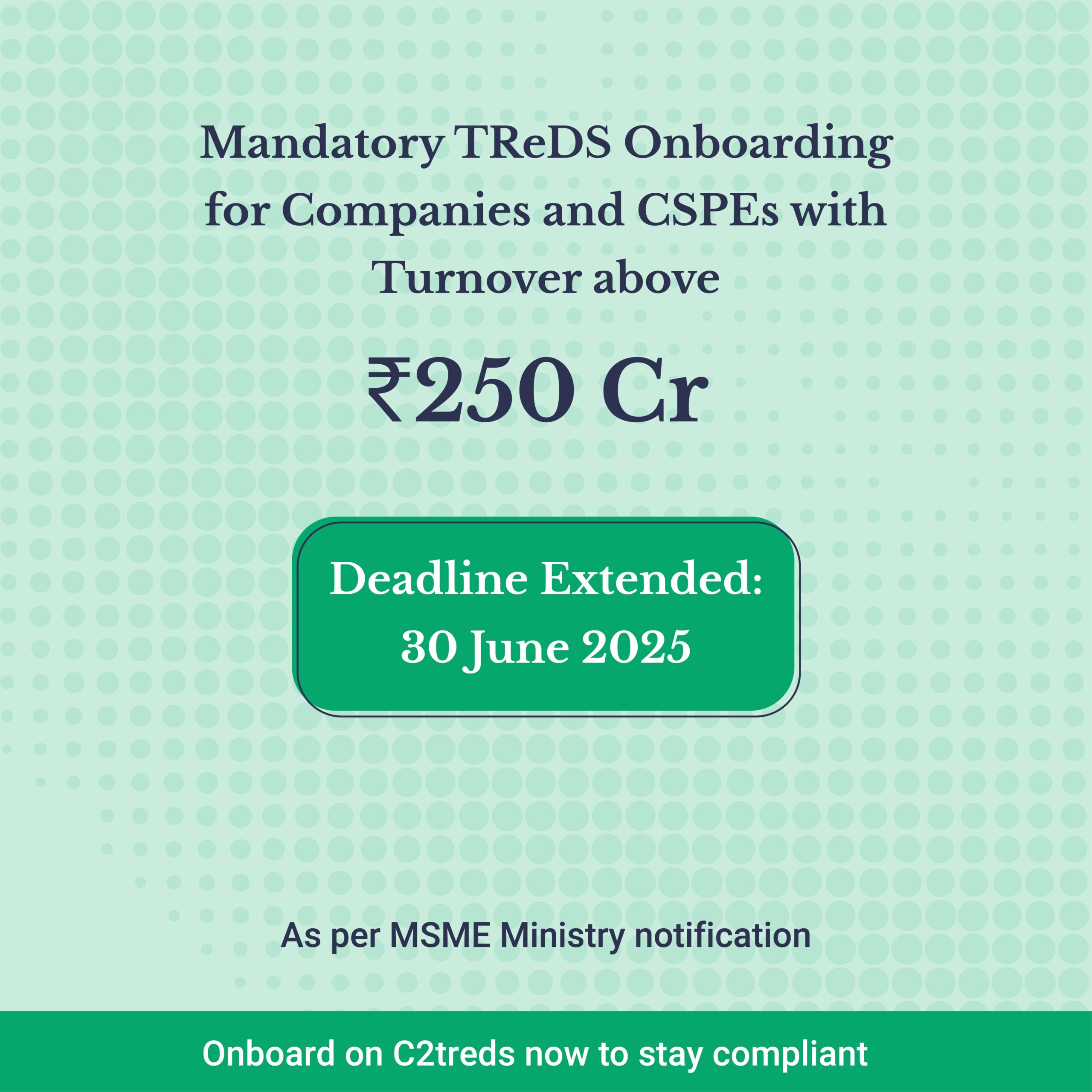

Eligibility Criteria for MSME Suppliers

As per revised MSME classification norms (effective April 1, 2025)VVerify your eligibility and complete your KYC to join the C2treds community today:

- Micro Enterprises: Investment ≤ ₹2.5 Cr and Turnover ≤ ₹10 Cr

- Small Enterprises: Investment ≤ ₹25 Cr and Turnover ≤ ₹100 Cr

- Medium Enterprises: Investment ≤ ₹125 Cr and Turnover ≤ ₹500 Cr

These thresholds reflect the 2.5× increase in investment limits and 2× increase in turnover limits announced in Budget 2025 to help MSMEs grow without losing MSME benefits.

A valid Udyam Registration is mandatory to participate on C2treds.

Ready for faster, collateral-free working capital?

Let’s get started.

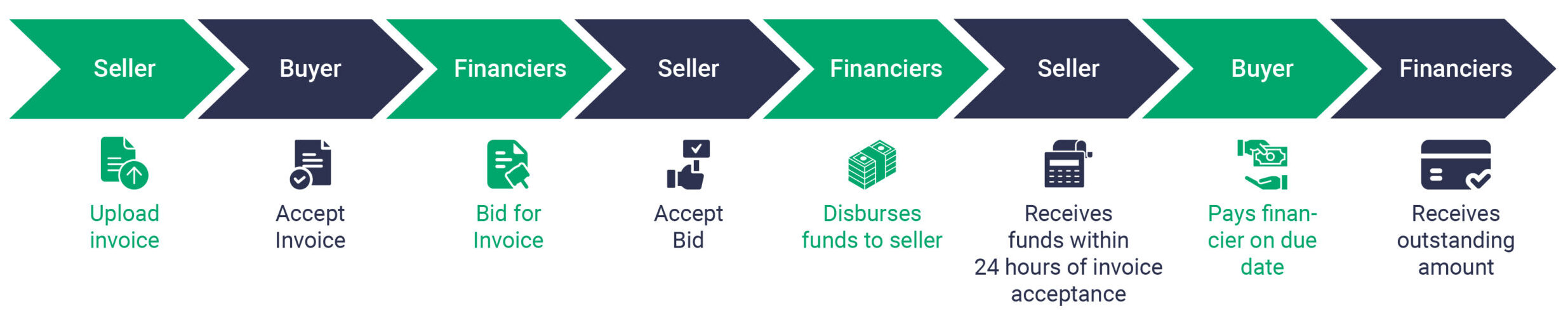

Facilitating Factoring Transactions with Ease

In a standard factoring transaction

-

1.Seller

Upload

Invoice -

2.Buyer

Accept

Invoice

-

3.Financiers

Bid for

Invoice -

4.Seller

Accept

Bid

-

5.Financiers

Disburses

funds to seller -

6.Seller

Receives funds within 24 hours of invoice acceptance

-

7.Buyer

Pays financiers on due date

-

8.Financiers

Receives outsanding amount

Streamlining Reverse Factoring Transactions

In a reverse factoring transaction

-

1.Buyer

Upload

Invoice -

2.Financiers

Bid for

Invoice

-

3.Buyer

Accept

Best Bid -

4.Financiers

Disburses

funds to Seller

-

5.Seller

Receives funds within 24 hours

-

6.Buyer

Pays financiers on due date/expanded date

-

7.Financiers

Receives outsanding amount