- Early MSME payments powered by C2FO

What the Government’s TReDS Compliance Mandate Means for Your Business

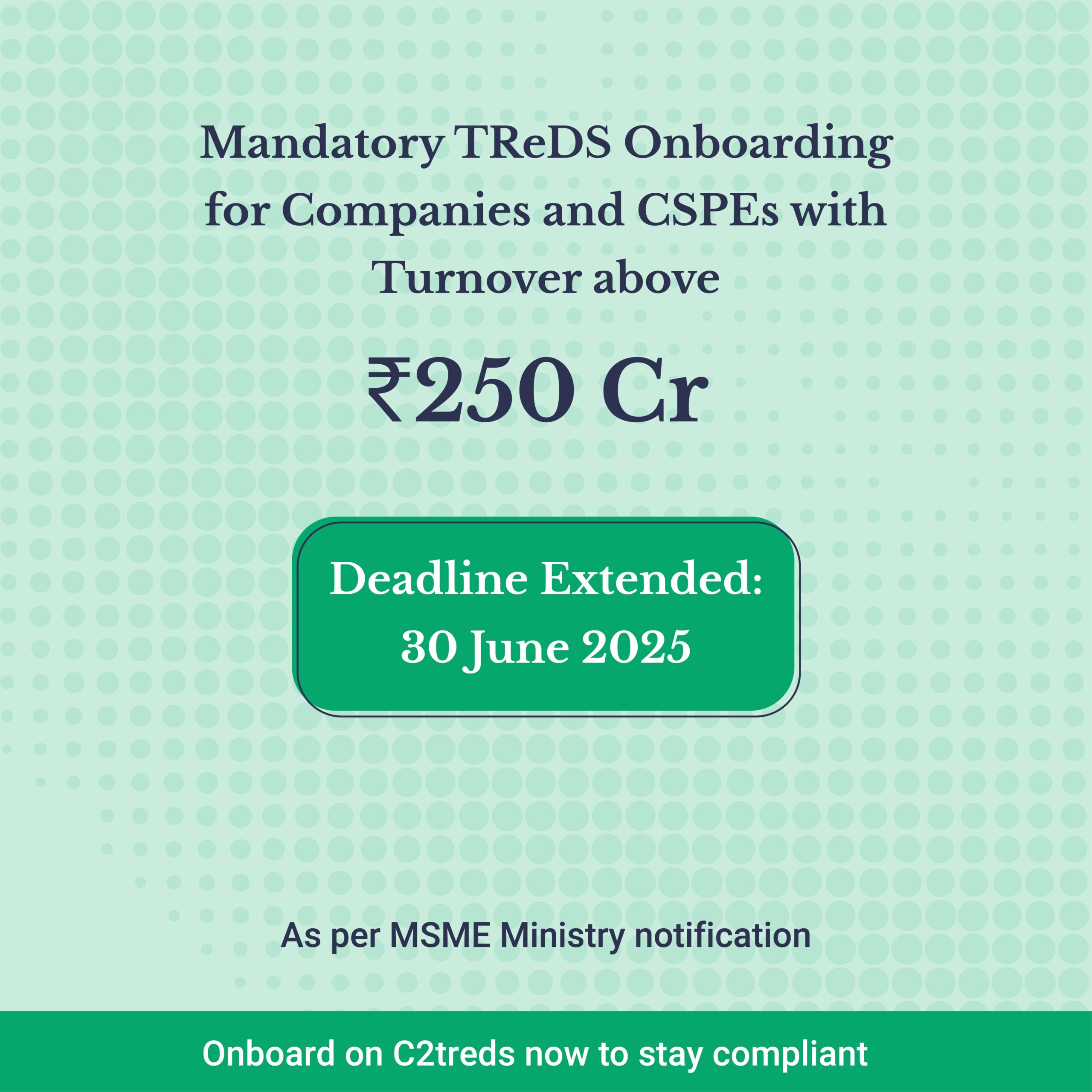

MSME Ministry Mandates all corporates and CPSE exceeding 250 Cr should onboard TReDS

The Compliance Deadline and What Happens If You Don’t Act

The government has set March 31, 2025 as the compliance deadline for corporate buyers. By this date, companies with annual revenues above ₹250 Crores and all central public sector enterprises must be fully onboarded to a TReDS platform. This is being mandated to eventually route MSME supplier payments through it.

What happens if corporate buyers miss the March 31, 2025 deadline?

- Regulatory action – Non-compliance can lead to penalties and legal scrutiny from regulatory authorities.

- Supplier dissatisfaction – MSMEs are now actively aware of their rights under the directive, and they may start avoiding non-compliant buyers.

- Reputation risk – Companies that fail to comply may be publicly listed as non-compliant, affecting business relationships and credibility.

- Cash flow inefficiencies – Without TReDS, companies risk inefficient payment cycles, which can disrupt supplier relationships and procurement strategies.

Clearly, this isn’t something businesses can afford to overlook.

Common Misconceptions About TReDS Compliance

As with any regulatory requirement, there are plenty of misconceptions about TReDS. Let’s clear up the most common ones.

- Only MSMEs need to register for TReDS

This compliance mandate is targeted at large corporate buyers – companies with annual turnover above ₹250 Crores and all central public sector enterprises, and not MSMEs. While MSMEs benefit from the system, this mandate unloads the responsibility on large businesses to register and facilitate payments through TReDS.

- We already pay our MSME suppliers on time, so we don’t need to comply

Even if your company has a commendable payment track record, compliance is mandatory. It’s not about your internal processes – it’s about ensuring MSMEs have access to multiple options such as invoice factoring. Even if you pay early enough, your suppliers may still prefer to discount their invoices through TReDS for better cash flow management.

- Only government companies need to comply

The directive applies to all businesses with annual turnover above ₹250 Crores in addition to all Central Public Sector Undertakings (PSUs). If your business meets the eligibility criteria, you must onboard.

- Onboarding is complex and time-consuming

At C2treds, we have streamlined the TReDS onboarding process to make it as smooth and easy as it can get. With us, ensuring compliance is quick and hassle-free for your organisation. Most businesses can complete registration and start processing transactions in a matter of days if you follow the right steps. You’ll also have expert advisory guidance from us throughout the journey.

More Than Just a Mandate – How TReDS Benefits Your Business

While compliance is the immediate concern, the real story here is that TReDS actually benefits businesses beyond just following regulations.

- Stronger supplier relationships

When suppliers know they can receive early payments through TReDS, they tend to have more confidence in their buyers. This can lead to better partnerships, preferred pricing, and improved service levels.

- Improved working capital management

With TReDS, corporate buyers can optimise their cash flow by timing payments efficiently without negatively impacting suppliers. It’s a win-win for both parties.

- Enhanced transparency & compliance readiness

TReDS transactions are digital and fully trackable, reducing disputes and making audit trails simpler. This makes compliance with future financial regulations easier as well.

- Access to a wider MSME network

Businesses that are compliant with TReDS may find it easier to attract and onboard more MSME suppliers, expanding their sourcing options. More suppliers = better competition = better pricing.

What Should You Do Next?

With the March 31 deadline looming close, businesses should take immediate steps to become compliant:

- Registering on a TReDS platform – C2treds offers an easy and efficient way to onboard. Register your interest HERE.

- Review MSME vendor contracts – Ensure you’re routing eligible payments through the platform. Although this is optional, this can enhance your cash flow

- Educate internal teams – Your procurement, finance, and compliance teams need to understand how TReDS transactions work.

- Communicate with MSME suppliers – Help them understand the benefits of the system so they can actively participate too.

If you haven’t started this process yet, now is the time to become #TReDSready. Non-compliance isn’t worth the risk, and the benefits of TReDS make it a smart financial move for any business.

Final Thoughts

The government’s TReDS compliance mandate is more than just a regulatory requirement – it’s a strategic shift toward faster, more transparent supply chain financing.For corporate buyers, this is a chance to improve cash flow management, strengthen supplier relationships, and future-proof financial operations.

With platforms like C2treds, onboarding is seamless, and the long-term benefits far outweigh the effort of compliance. Don’t wait until the last minute – get started today and turn compliance into a competitive advantage.